tax avoidance vs tax evasion examples

Mailing tax forms on time C. The IRS has rules about cryptocurrencies and their transactions are taxable.

Which Is More Bad Tax Avoidance And Tax Evasion Read To Know More Income Tax News Judgments Act Analysis Tax Planning Advisory E Filing Of Returns Ca Students

Call 247 713-775-3050.

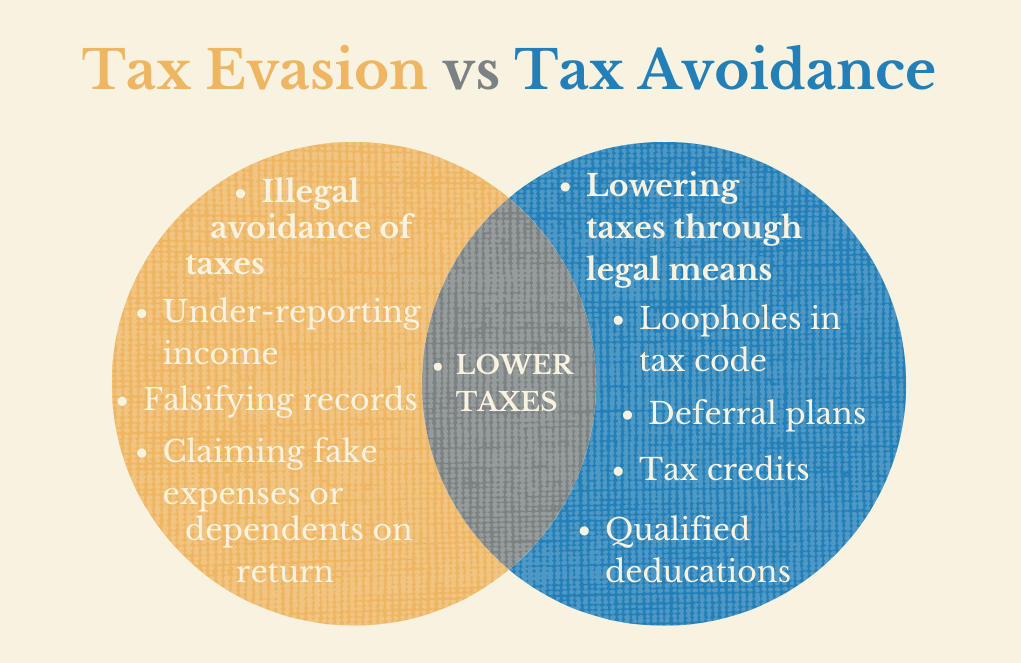

. This includes using multiple financial ledgers hiding or. 1 Ignoring overseas income. Though both the processes reduce the tax amount they differ in legal terms.

Is tax avoidance legal or illegal. Tax evasion occurs when the taxpayer either evades assessment or evades payment. Hiding interest such as that from offshore accounts.

For example in the United States the federal tax code provides a wide range of incentives for corporations totaling 109 billion in 2011 according to a Tax Foundation Study. Deliberately under-reporting income the most common cases include those who run cash businesses and keep their true income under wraps. Often taxpayers can overlook their cryptocurrency holdings that have increased in value.

Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes. Typically tax evasion schemes involve an individual or corporation misrepresenting their income to the Internal Revenue Service. Fines for tax evasion range from 100000 per year to a one-time payment of 250000 depending on the crime.

Federal income tax than necessary because they misunderstand tax laws and fail to keep good records. There are prison sentences and hefty fines. Payment of tax is avoided through illegal means or fraud.

1 Keeping a log of business expenses. Staying Compliant With Your Tax Payments. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law.

When you avoid tax payment via illegal means it is called tax evasion. Tax Avoidance vs. The other one is the evasion of payment.

Tax evasion is a federal offense. This could include travel. According to the IRS tax avoidance is an action you can take to reduce your tax liability and therefore increase your after-tax income.

Activity 1 Circle each example of tax evasion. Ignoring earnings for pet-sitting D. Tax avoidance on the other hand is when you arrange your income in a manner that legally allows you to pay the lowest amount of taxes.

While tax avoidance is a legal way of reducing the tax to be deducted from the gross income tax evasion Tax Evasion Tax Evasion is an illegal act in which the taxpayers deliberately misreport their financial affairs to reduce or evade the actual tax liability. Get the detail with more examples in this article. Tax evasion can have other undesirable consequences too.

Hiding or transferring assets. This often affects people with rental properties overseas. Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals corporations trusts and othersTax evasion often entails the deliberate misrepresentation of the taxpayers affairs to the tax authorities to reduce the taxpayers tax liability and it includes dishonest tax reporting declaring less income profits or gains than the amounts actually earned overstating.

Using Tax Avoidance to Your Advantage and Avoiding Tax evasion. Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden. It is undertaken by employing unfair means.

Examples of tax evasion. In fact theres an entire industry built around this conceptits called tax consultancysomething we love helping clients with here at Bookly. This includes not paying taxes you owe even though your income is reported.

Ignoring earnings for pet-sitting. In avoiding legal and financial ruin be sure to know how to prevent tax evasion. Tax evasion means concealing income or information from tax authorities and its illegal.

425 21 votes Tax evasion is using illegal means to avoid paying taxes. For instance the transfer of assets to prevent Uncle Sam from estimating their actual tax liability is an attempt to evade review. Tax evasion is the use of illegal means to avoid paying your taxes.

Tax evasion involves the use of illegal means to. In the United States tax evasion constitutes a crime that may give rise to substantial monetary penalties imprisonment or both. Tax avoidance means using the legal means available to you to reduce your tax burden.

Payment of tax is avoided though by complying with the provisions of law but defeating the intention of law. Not reporting interest earned on loans C. This is one of the most common tax evasion examples.

Take advantage of each deduction. To assess your answers click the Check My Answers button at the bottom of the page. Keeping accurate and organized records E.

Deductions are a great way to reduce your taxable income. Definition and Examples. Let us discuss some of the major differences.

Are you unsure of the difference in tax avoidance vs. While you wont need to figure out the entire tax code to avoid being charged with tax evasion you should have a working knowledge of the. Select Popular Legal Forms Packages of Any Category.

Examples of tax evasion. One could incur fines of up to 250000 to 500000. All Major Categories Covered.

Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. Tax Evasion vs. 6 rows Key Differences between Tax Evasion vs Tax Avoidance.

This occurs either when the taxpayer does not pay tax or bypasses assessment. The examples below are all classed as tax evasion and are therefore illegal. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Youve seen the examples of tax evasion and tax avoidance above. If you or a loved one has been accused of tax evasion you will of course need to work. The IRS will deduct expenses for non-reimbursed business expenses.

What is tax evasion. Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of tax evasion. Tax evasion on the other hand is using illegal means to.

Tax avoidance means legally reducing your. 2 Banking on Bitcoin. For example if someone transfers assets to prevent the IRS from determining their actual tax liability there is an attempted to evade assessment.

Depending on where a persons tax evasion crime lands in the set categories they may face a prison sentence of anywhere from one to five years. Tax exclusions for local bonds valued at 124 billion. If income is not reported by someone authorities do not possess a tax claim on them.

Here are some examples of tax evasion. It is undertaken by taking advantage of loop holes in law. The above and many others are examples of tax evasion which comes with stiff penalties backed up by law.

Tax Evasion vs. The Tax Foundation categorizes US federal tax incentives into four main categories listed below. For example you may have a higher audit risk and your accountant may refuse to work with you on ethical grounds.

Examples of Tax Evasion. Some may only pay a part of their taxes and leave out the rest. And yes this is legal.

Conversely tax evasion is the failure to pay or the intentional underpayment of your taxes. Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits. Keeping a tip log B.

New business owners might not.

Tax Avoidance Vs Tax Evasion Loans Canada

What Is Money Laundering Tax Evasion Cra

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Fraud And Tax Evasion Penalties Explained Gobankingrates

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Facts 2022 Released By Canadian Tax Lawyers Rotfleisch Samulovitch

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Tax Avoidance Definition Comparison For Kids

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

How Fortune 500 Companies Avoid Paying Income Tax

What S The Difference Between Tax Avoidance And Tax Evasion How To Plan Business Template Helping People